🪙 知っておくべき、ESG投資のこと

投資によって「悪い」企業は本当に淘汰されていくなんてことが、ほんとうに実現可能なのでしょうか?そして、持続可能性と運用収益を両立させることは可能なのでしょうか。

この数年、「ESG」(環境、社会、企業統治)ということばを耳にする機会が増えました。それは資産運用の世界も同じ。企業の財務指標だけでなく持続可能性や社会的責任を重視した投資を求める声が高まっています。

ESGを考慮した投資という理念が注目を集めるようになったのは15年ほど前ですが、その後に気候変動問題が深刻視されるようになったこともあり、多くの投資家が短期的な利益の追求のみを目的としたビジネスモデルには将来性がないと考えるようになっています。

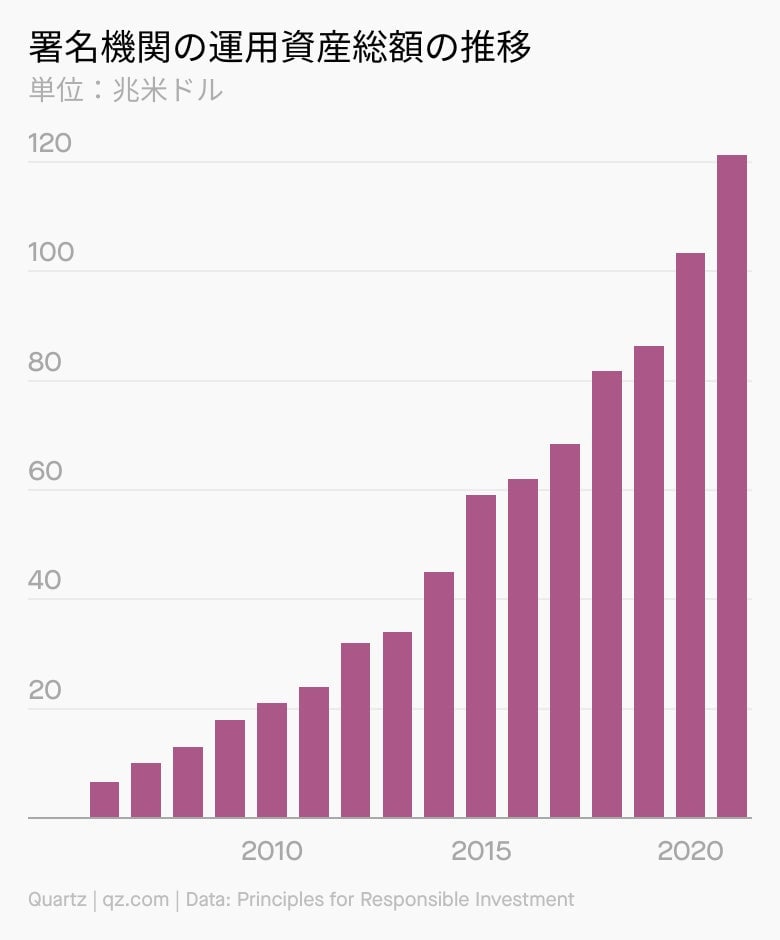

こうしたなか、大手金融機関や資産運用会社は軒並みESGの理念に沿った投資に注力する姿勢を打ち出しています。ESGをテーマにした上場投資信託(ETF)が人気を集め、グリーンボンドのようなESG債(SDG債)の発行も増えており、いまや世界の資産運用総額の3分の1以上が広い意味でのESG投資だとする統計もあります。

ただ一方で、ESGは評価が難しく「ウォッシュ」(見せかけや偽り)につながりやすいとの問題もよく指摘されています。また、ESG要素を組み入れると投資パフォーマンスが低下するとの分析もあり、特に年金基金などの大型機関投資家にとっては悩ましい問題となっているのです。

投資によって世界の資本を環境や社会によい方向に誘導していくことができるという理論は確かに魅力的ですが、ESG投資が広まることで「悪い」企業は本当に淘汰されていくのでしょうか。そして、持続可能性と運用収益を両立させることは可能なのでしょうか。

BY THE DIGITS

数字でみる

- 35兆3,000億ドル(約5,058兆円):2020年のESG投資の総額。2018年から15%増加しており、2025年までに50兆ドルに拡大する見通し

- 35.9%:2020年の世界の資産運用総額に占めるESG投資の割合。日本ではESG投資の割合は24.3%だった

- 1兆240億ドル(147兆8,000億円):2021年の世界のESG債の発行総額。同年の世界の債券発行総額の11%を占める。2022年には1兆5,000億ドルに達する見通し

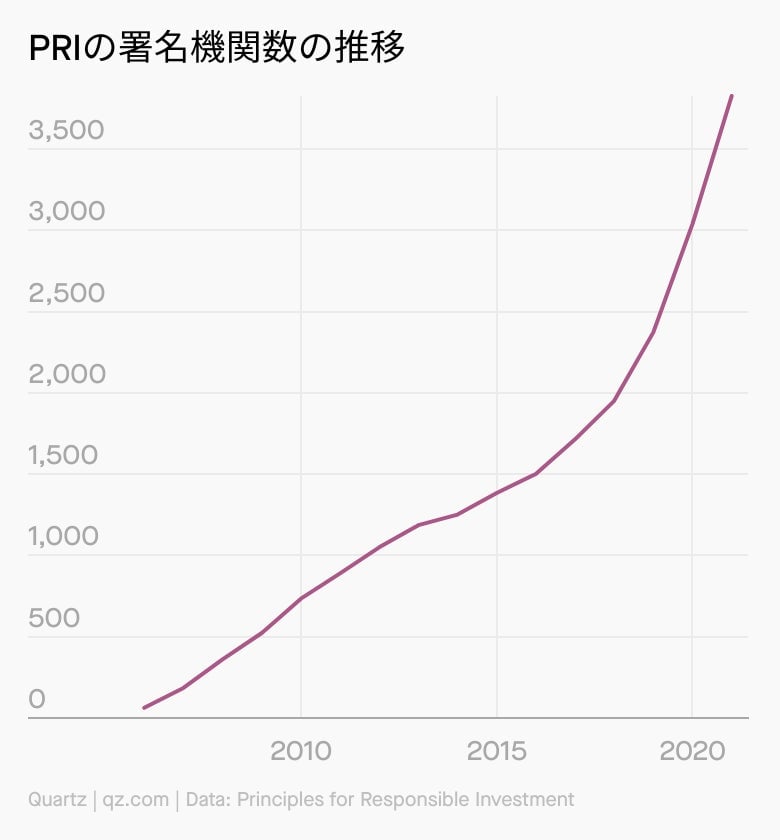

- 5,154機関:国連の「責任投資原則(Principles for Responsible Investment、PRI)」に署名する機関の数。内訳は資産運用機関が3,932(76%)、アセットオーナーが707(14%)、サービス機関が527(10%)となっている

- 72%:資産運用会社に対して投資戦略にESGを組み込むことを望む顧客の割合

BRIEF HISTORY OF SRI

社会的責任投資…?

経済活動において倫理的な側面を重視する動きは、ESGという言葉が誕生するはるか以前から存在しました。これは宗教的な信念に基づくものが多く、例えば18世紀の英国国教会の司祭でメソジスト運動の指導者のジョン・ウェスレー(John Wesley)は、商業活動において隣人に害を成さないことや、皮なめしや化学工業のように労働者の健康に影響を及ぼすような産業には関わらないように説いています。

投資という観点からは、1920年代に米国のキリスト教教会が、教義で禁止されていたタバコやアルコール、ギャンブルなどを資産運用の投資対象から除外したのが、社会的責任投資(Socially Responsible Investment、SRI)の始まりとされます。このほか、アパルトヘイトが行われていた時代の南アフリカへの投資の停止や、対パレスチナ政策を理由としたイスラエルからの投資引き揚げなども、SRIに含まれるでしょう。

一方、1990年代に環境問題が注目を集めるなか、企業の社会的責任において、倫理的なことだけでなく持続可能性が重視されるようになりました。2006年には、当時の国連事務総長コフィ・アナン(Kofi Annan)が「責任投資原則(PRI)」というイニシアチブを提唱します。これは世界の機関投資家に対し、受託者責任の範囲内でESGを組み込んだ投資決定を促すもので、現在では世界60カ国以上の年金基金や資産運用機関など5,154機関が署名しています。

また、2017年には国際金融システムの監視などを行う金融安定理事会(Financial Stability Board、FSB)が立ち上げた気候関連財務情報開示タスクフォース(TCFD)が、企業に対して気候変動が事業に及ぼす影響の開示を求める提言を公表しました。

QUIZ

ここで問題です

ブラックロック(BlackRock $BLK)やバンガードグループ(The Vanguard Group)をはじめとする世界の資産運用会社トップ10のうち、PRIに署名している企業は何社あるでしょう。

- 1社

- 5社

- 7社

- 10社

答えは、④10社すべてです。民間の資産運用会社の上位10社はいずれも欧米企業で、PRIに署名しています。

これに対し、同じ大手機関投資家でも、世界の政府系ファンドのトップ10 のうちPRIに参加しているのは、ノルウェー政府年金基金グローバルと香港金融管理局の2機関にとどまっています。これは政府系ファンドの上位は中東の産油国や中国などの基金で占められており、こうしたファンドは環境分野での投資には積極的な一方で、人権や社会的な面での対応は遅れているためです。

なお、日本の厚生年金と国民年金を管理する年金積立金管理運用独立行政法人(GPIF)は2015年にPRIに署名しました。

TYPES OF ESG INVESTMENT

ESG投資の種類

ESG投資では具体的にどのようなアプローチが取られているのでしょう。世界各地域のESG投資協会7団体で構成される世界持続的投資連合(Global Sustainable Investment Alliance、GSIA)は、ESG投資の手法を7つに分類しています。

ESG統合(ESG integration):もっとも広く行われている方法で、投資先を決めるときに業績などの財務情報だけでなくESG情報も含めて企業を分析し選択を行う方法

- エンゲージメントと株主の行動(Corporate engagement & shareholder action):情報開示請求、株主総会での議案提出や議決権行使など直接働きかけることで、投資先の企業にESGへの配慮を促していく

- 規範に基づくスクリーニング(Norms-based screening):ESGに関する国際規範や基準を満たしていない企業を投資対象から除外する手法で、人権関連や環境対策などで問題のある企業には投資をしないポートフォリオを構築する

- ネガティブスクリーニング(Negative/exclusionary screening):かつての社会的責任投資でよく行われていた手法で、例えば兵器産業や化石燃料産業など特定の分野を投資ポートフォリオから除外する

- ポジティブスクリーニング(Best-in-class/positive screening):ESG評価の高いセクターや企業に積極的に投資していく戦略

- 持続可能性テーマ投資(Sustainability themed/thematic investing):クリーンエネルギー、多様性の促進、持続可能な農業など特定のテーマを選んで、それに貢献している企業に投資する

- インパクト投資とコミュニティ投資(Impact investing and community investing):社会的な問題や環境対策に貢献する技術やサービスを提供する企業に投資することで、投資収益を得るだけでなく社会に直接プラスの影響を与えることを目指す戦略

ESG INVESTING CHALLENGES

3つの課題

📈 統一の評価基準がない

ESG投資で一番の問題は、投資先の選定が非常に難しい点です。昨今のESGへの関心の高まりを受けて関連データの情報開示を行う企業は増えていますが、開示対象や基準などに統一のルールはなく、統一の会計基準の下で作成された財務情報などのIRデータと違って、定量的な評価や比較をすることは容易ではありません。

外部機関による企業のESG評価も行われていますが、結果にはばらつきがあります。例えば、業界大手であるリフィニティブ(Refinitiv)、MSCI、サステイナリティクス(Sustainalytics)がそれぞれ発表しているESGスコアを比べても、3社すべてが取り上げている企業1,469社のうち942社については評価が割れているのです。

これは各社が独自の基準や方法論で評価を行なっているためで、企業が独自の判断でまとめた非統一のESGデータをばらばらな手法で分析すれば、結果が異なるのは当然です。また、投資を考えている企業が外部機関の評価の対象になっていないという場合もあるでしょう。

では、S&Pダウ・ジョーンズ・インデックスやFTSEなど、金融指数大手が提供するESG指数はどうでしょう。ESG指数はESG投資の世界では重要な役割を担っており、市場にはさまざまなESG指数に連動したETFが出回っています。しかし、ESG指数連動型のETFが本当にその目的を果たしているかについて、投資家の意見は分かれているようです。

トゥルーマーク・インベストメント(TrueMark Investments)のジョーダン・ワルドレップ(Jordan Waldrep)が行った分析によれば、温室効果ガスの排出量だけに焦点を絞った場合、市場で人気のあるESG ETF商品のいくつかは、S&P500種株式指数に連動するETFと大差がないことがわかっています。S&P500連動型ETFから単純に排出量の最も多い企業数社を除くだけで、大半のESG ETFよりも排出量が少なくなるのです。

もちろん排出量はESGの指標のひとつに過ぎず、各社のESG指数が必ずしも不正確ということではありません。ただ、指数を追っていればそれだけで望むような理念に沿った投資が保証されるということではないという点は覚えておくべきでしょう。

🤯 「ウォッシュ」の恐れ

ESG投資は評価が複雑で難しいために、さまざまな「ウォッシュ」につながることが多くあります。明確に騙す意図がない場合でも、例えばESGをうたった投資商品で具体的に何をもって「社会的責任」としているのか、どのような基準で銘柄の選定を行なっているか、運用プロセスはどうなっているのかなどの説明が不明確で、結果的に顧客が想像していたような投資が行われていないといったことが起きているのです。

最近では、5月末にドイツ銀行(Deutsche Bank)の資産運用部門DWSが実際にはESG要素を考慮していない投資商品を「グリーン投資」と偽って販売したとの疑惑で検察当局の捜索を受けたほか、6月にはゴールドマン・サックス(Goldman Sachs $GS)のESG商品の顧客向け資料が投資実態と一致していないとして、米証券取引委員会(SEC)が調査に入ったというニュースがメディアを賑わせました。

SECは5月にESGファンドの情報開示をめぐる新たな規制案を発表しており、各国の金融当局も規則の整備や強化によるウォッシュへの対応を進めています。しかしESGは対象が膨大で定量評価が難しいことも多く、例えば国際会計基準(IFRS)のような統一のルールを設定し、それに基づいて当局が厳格なモニタリングをしていくことが可能なのかは未知数です。

💰 (短期的には)運用成績が悪い

ESG投資でもうひとつ指摘されるのは、少なくとも短期的には一般の投資商品と比べて運用成績が悪いという点です。ニューヨーク大学の経営大学院スターン・スクール・オブ・ビジネス(New York University Stern School of Business)の研究者たちが行った分析では、世界の株価は過去5年で平均8.9%伸びたのに対し、ESGファンドのリターンは平均で6.3%にとどまりました。

ESGに注力する企業が増え、銘柄の選択手法も洗練されていくなかで、ESGファンドのパフォーマンスは改善しています。しかし、そもそもESG投資のリターンが通常より良いのであれば、国際機関などが呼びかけるまでもなく、資産運用においてはESG投資が主流となっているはずです。資産運用会社はこぞって企業のESGデータを収集し、さまざまな分析ツールを開発して積極的にESGを考慮した投資を行うでしょう。

長期的にはESGに積極的な企業の方が業績は伸びると考えられていますが、短期間の投資リターンを最大化するという意味では、現時点ではESG投資が最良の選択肢だとは言えないのかもしれません。

ONE 👨🦳 THING

ちなみに…

「投資の神様」のあだ名をもつウォーレン・バフェット(Warren Buffett)は、ESG投資についてどのような見方をしているのでしょう。バフェットの資産運用会社バークシャー・ハサウェイ(Berkshire Hathaway $BRK.B)は、再生可能エネルギー事業への投資を強化しています。また、同社の保有株で特に大きなリターンを上げている銘柄としてBNSF鉄道(BNSF Railway)やエネルギー事業のバークシャー・ハサウェイ・エネルギー(Berkshire Hathaway Energy)が知られていますが、バフェットは今年の「株主への手紙」で、これらの企業は着実に環境問題に貢献していると強調しました。

ただ、彼は2019年の『Financial Times』のインタビューで、企業の経営陣や投資家が独自の見解に基づいて「良いことをする」よう押し付けるのは誤りだと話しています。バフェットは「経営陣も投資家も社会にとって何が最良であるかを知ることはできない」と断った上で、その「良いこと」をするために使われるのは「株主のお金なのだ」との持論を展開します。そして同時に、市場システムの変革は投資によってではなく政策によってなされるべきだと述べました。

バフェットの有名な格言のひとつに「10年保有したくない株なら、たとえ10分でも持っているべきではない」というものがあり、長期な視点での投資という意味ではESG投資はこの戦略に合致するようにも思えます。また、バフェットは自身の死後は資産の99%を慈善事業に寄付することを決めており、社会的責任への関心は高いのでしょうが、それでも企業の最大の関心事は株主の利益を最大化することであるべきという信念にゆるぎはないようです。

Quartz Japanのニュースレターサービスは、2022年9月30日をもって終了いたします。終了の日までニュースレターの配信を続けて参りますが、年額会員の皆さんへの返金などサービス終了に伴うお手続きについて、こちらをご覧ください。